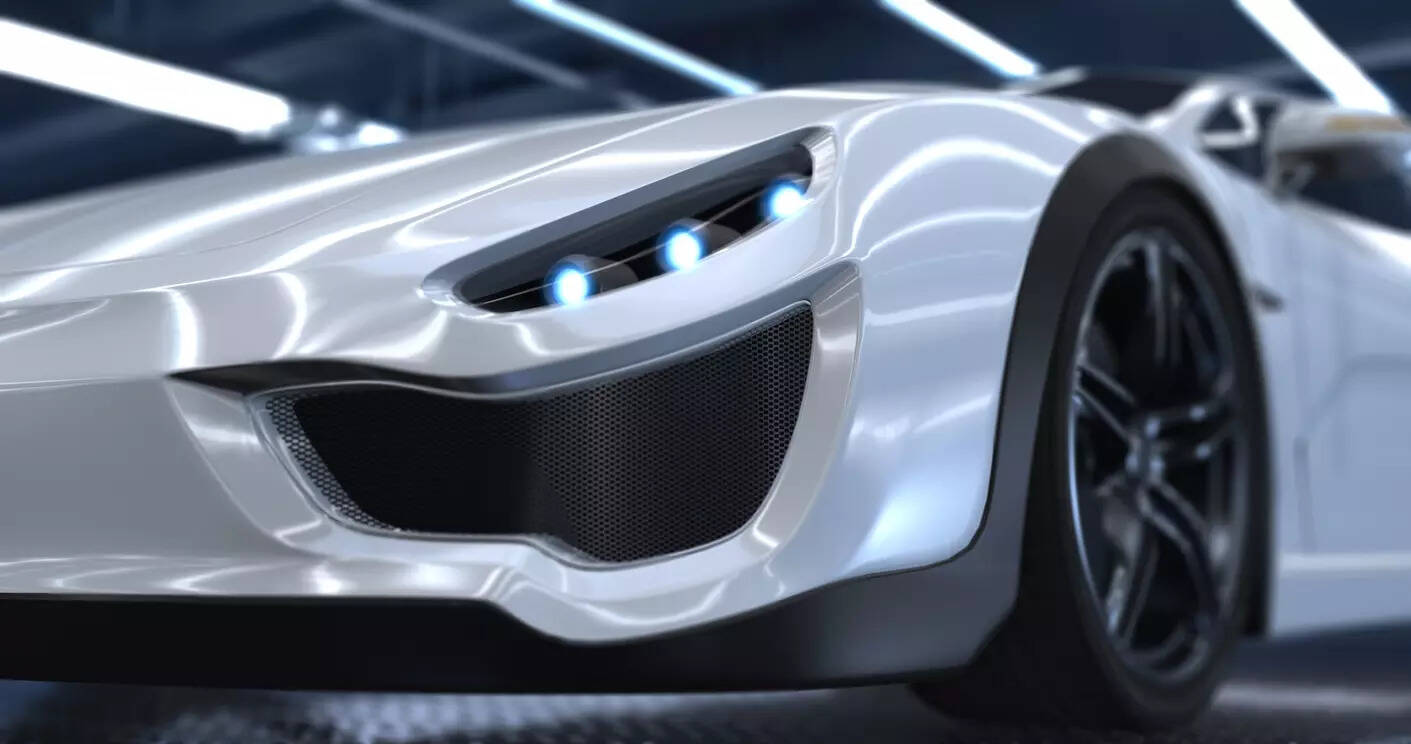

According to reports, about 40 per cent of cars that Jaguar and Land Rover (JLR) sells in India are imported as completely built units (CBU) either from the UK or its other production units in Europe.

According to reports, about 40 per cent of cars that Jaguar and Land Rover (JLR) sells in India are imported as completely built units (CBU) either from the UK or its other production units in Europe.The recently signed India–UK Free Trade Agreement (FTA), concluded during Prime Minister Narendra Modi’s official visit to the United Kingdom, is set to make high-end cars more accessible to Indians.

Under the agreement, officially known as Comprehensive Economic and Trade Agreement, Tariff Rate Quota (TRQ) mechanism has been introduced under which there is progressive customs duty reductions on a quota-based system over a span of 15 years.

The move can give a shot in the arm to imports of high-end British-made luxury cars such as Aston Martin, Jaguar Land Rover, Rolls-Royce, Bentley, and McLaren.

Agreeing with the possibility, Saket Mehra, Partner at Grant Thornton Bharat, said the phased reduction of import duties on UK-built passenger vehicles—from over 100 per cent to 10 per cent under a quota system—will make British luxury cars more accessible in India.

“In FY24, India imported passenger vehicles worth approximately $78.3 million from the UK, a figure expected to rise significantly under the new tariff regime,” he noted.

The agreement also includes a dedicated quota for electric and hybrid vehicles, reflecting the shift in UK manufacturing. On the components side, India exported auto parts worth $191.6 million to the UK and imported around $138.6 million in FY24. Tariff reductions are expected to enhance these trade flows.

UK exports of auto parts and engines to India are projected to increase by about £190 million ($240 million), indicating a reciprocal benefit. However, Mehra cautioned that the treatment of the UK’s Carbon Border Adjustment Mechanism (CBAM) would be critical.

“If Indian exports continue to face CBAM levies while UK goods enter India duty-free, it could impact the benefits India expects to reap from the FTA,” he added.

Fillip to CBUs

According to reports, about 40 per cent of cars that Jaguar and Land Rover (JLR) sells in India are imported as completely built units (CBU) either from the UK or its other production units in Europe. The import of these CMB units can significantly benefit from the FTA. In the last financial year (FY25), JL) sold 6,183 units in India, achieving a record-breaking 40 per cent year-on-year growth. On the other hand, Aston Martin, with a starting range of ₹3.29 crore in India, reportedly sold around 22 units in 2024, while Rolls Royce sold 60 cars in 2023.

Meanwhile, Tata-owned JLR is also planning to increase localisation of its vehicle manufacturing in India, with the production from its Tamil Nadu plant expected to start from early 2026.

With significant volumes sold in India, JLR is expected to be the biggest beneficiary of the trade agreement in the automotive category.

Shailesh Chandra, President, SIAM and Managing Director of Tata Passenger Vehicles Ltd & Tata Passenger Electric Mobility Ltd., said the FTA marks a significant step forward in strengthening India’s economic engagement with developed economies.

“The commitments made by the Government of India on automobile sector tariffs strike a thoughtful balance—addressing consumer interests while supporting the broader goals of Indian industry,” he said.

While the blueprint of the deal is still being decoded, it remains to be seen how the demand for luxury cars from the UK pans out.