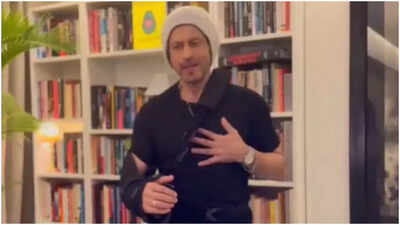

Unsoo Kim, Managing Director, Hyundai Motor India

Unsoo Kim, Managing Director, Hyundai Motor IndiaNew Delhi: With domestic sales under pressure, Hyundai Motor India Ltd (HMIL) reported a 8 per cent decline in consolidated net profit to ₹1,369 crore for the quarter ended June 30, 2025, compared to ₹1,490 crore in the same period last year. Domestic vehicle sales for Q1 stood at 1.32 lakh units, down 13 per cent year-on-year, from 1.49 lakh.

“The softness in demand continued to weigh on overall industry sentiment, driven by persistent macroeconomic challenges and further intensified by global uncertainties,” said Unsoo KimManaging Director, during the post-earnings media briefing on Wednesday.

Despite the dip in profitability, the company managed to maintain its PAT margin at 8.2 per cent in Q1 FY26, compared to 8.5 per cent in the corresponding quarter last year. The year-on-year margin contraction was primarily attributed to “higher discounting” levels.

Meanwhile, it also expressed cautious optimism about a gradual recovery in the coming quarters. It cited potential tailwinds such as a favourable monsoon, the upcoming festive season, and supportive government measures including possible interest rate cuts, income tax relief, and the anticipated implementation of the next pay commission.

The company’s COO Tarun Garg, stated that discount levels averaged 3.4 per cent during Q1, significantly lower than the industry average. “We expect this to remain in a similar range or slightly lower going forward. We don’t anticipate any increase in discounting.”

Hyundai also confirmed that it is not facing any disruption related to rare-earth magnets, citing adequate inventory coverage at present.

Exports, meanwhile, registered a robust 13 per cent year-on-year growth in Q1 FY26, rising to 48,140 units from 42,600 units in the same quarter last year. The growth was driven by strong demand from Africa and other emerging markets.

Product mix

Average selling price (ASP) for Hyundai in the domestic market rose marginally to ₹7.65 lakh in Q1 FY26, up from ₹7.60 lakh in the same quarter last year.

Creta continued to dominate its portfolio, contributing 36 per cent to overall sales, followed by the Venue at 17 per cent, Exter at 13 per cent, Aura at 11.2 per cent, Grand i10 at 10 per cent, and the i20 at 9 per cent. The share of first-time buyers remained steady at around 40 per cent.

SUVs made up 69 per cent of Hyundai’s total sales portfolio in Q1 FY26, highlighting the continued consumer shift away from hatchbacks, which saw a year-on-year decline, while sedan volumes remained relatively flat.

Garg noted that consumer demand is evolving, particularly in the sub-₹10 lakh segment. “This body type didn’t exist five years ago. Today, in the ₹6-8 lakh range where customers once opted for hatchbacks, they now prefer compact SUVs like the Exter, offering greater space, higher ground clearance, elevated seating, and six airbags as standard,” he said.

CNG variants contributed over 16 per cent to Hyundai’s overall sales portfolio, while EV contribution remained modest at 1.4 per cent for the quarter. Meanwhile, diesel variants accounted for around 20 per cent of its total sales mix during the period.

The carmaker has recently commenced engine production at its Talegaon (Pune) plant, which will cater to both its Chennai and Pune manufacturing operations. The new facility has an installed capacity of 1.5 lakh engines. While the company has not confirmed export plans yet, it noted, “We will take a call”.

CAFE norms

Amid the ongoing industry tussle between Maruti Suzuki and Mahindra & Mahindra over exemptions for small cars under the proposed fuel efficiency norms, Hyundai has largely refrained from picking a side.

Addressing the matter, Garg said, “Whatever representations we make, we make them through SIAM. We trust that SIAM will take all industry concerns to the government.”

Garg noted that the Creta EV will play a key role in helping Hyundai meet Corporate Average Fuel Economy (CAFE) norms. “In Q1, the CAFE target was 117.286, and we achieved 112.856, exceeding the requirement by 4.430 points. So, we comfortably passed the CAFE compliance,” he said.

Hyundai Motor India will host its first-ever Investor Day on October 15, 2025. As part of its growth agenda, the company has announced plans to launch 26 new products by the end of FY30, spanning internal combustion engine (ICE), electric, and alternative fuel segments.

.jpg?w=700&c=0)