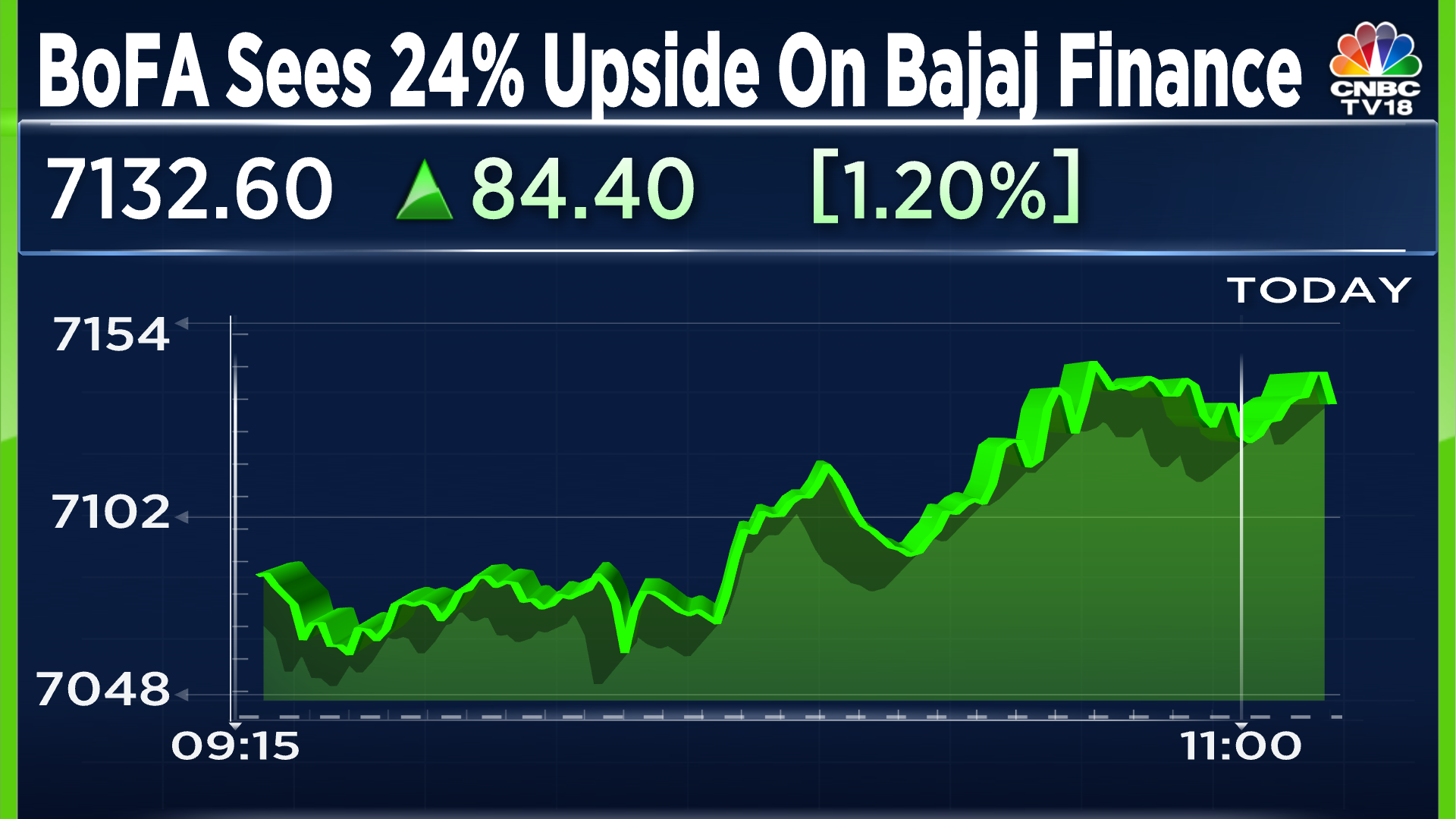

Analysts at BoFA Securities expect a potential upside of up to 24 percent on shares of Bajaj Finance in the next 12 months, citing multiple levers to growth.

BoFA Securities recommended a buy rating on Bajaj Finance with a price target of Rs 8,750, which is the 12th highest price target for the stock on the street. Anand Rathi has the highest price target on Bajaj Finance of Rs 9,600, followed by Bajaj Finance and JM Financial with Rs 9,500 each.

The brokerage said that their bullish strance is driven by the company’s focus on diversification, proactive action on unsecured growth and keeping targets of financial year 2024 intact.

BoFA’s note further said that access to new liquidity pools would make up for the high cost of funds (CoF) in the near term.

Listing key growth drivers for Bajaj Finance, BoFA Securities stated that customer acquisition funnel widening and new loan acceleration on capacity build up in sales finance would boost growth.

Shares of Bajaj Finance are up for the second day in a row after a five-day losing streak ahead of the listing of Jio Financial Services. The stock had ended as the top gainer on the Nifty 50 index on Monday as well.

This bullish call comes amidst concerns that Jio Financial’s listing will disrupt the financial services industry of which Bajaj Finance is a significant player. InCred in a note on Monday also said that incumbents like Bajaj Finance will not be under threat due to the Jio Financial listing.

Shares had declined as much as 10 percent since July 20, which was the record date for Jio Financial Services shares.

Bajaj Finance reported a 27 percent year-on-year growth in net interest income at Rs 6,718 crore for the June quarter as against the CNBC-TV18 poll of Rs 6,997 crore.

Shares of Bajaj Finance rose 1.2 percent at Rs 7,130.55. The stock is up 9 percent on a year-to-date basis.