NEW DELHI : The Adani Group faced fresh allegations of opaque financial dealings after a global network of investigative journalists published a report alleging that the company invested millions of dollars in its own companies through secret offshore structures.

The Organized Crime and Corruption Reporting Project’s (OCCRP’s) investigations, published by The Guardian and Financial Times, dragged down the market value of the 10 Adani group stocks by ₹35,210 crore.

Two associates of Vinod Adani, the elder brother of Adani Group founder Gautam Adani and a member of the promoter group, are alleged to have created a complex web of structures within a foreign fund based in Bermuda to trade in Adani stocks. The two individuals, Nasser Ali Shaban Ahli of the United Arab Emirates and Chang Chung-Ling of Taiwan, are said to have used the Global Opportunities Fund to trade in Adani stocks without disclosing their business ties with the Adani family.

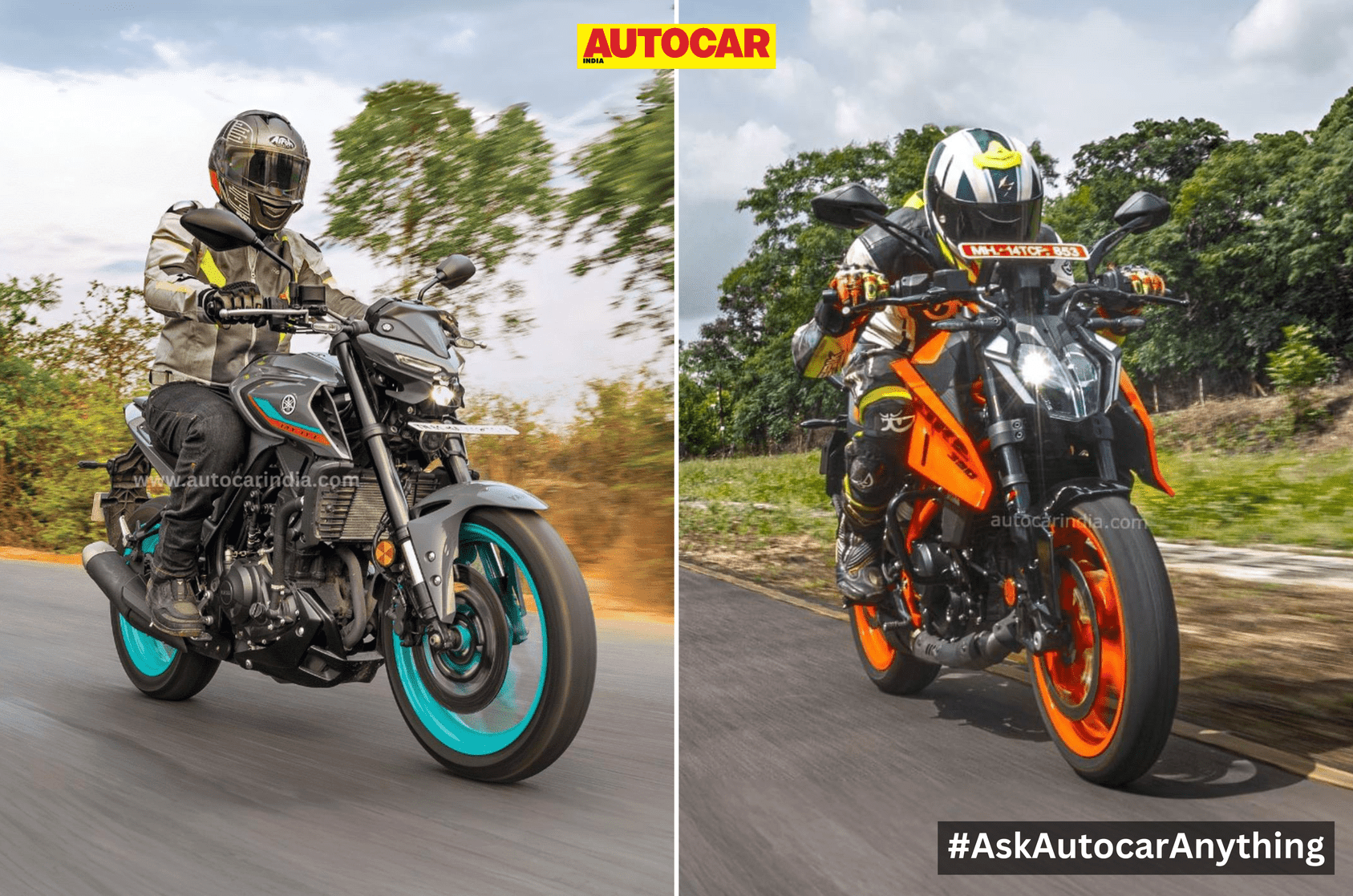

View Full Image

The reports also claimed that the Directorate of Revenue Intelligence (DRI), India’s apex anti-smuggling intelligence gathering body under the finance ministry, wrote to the markets regulator, the Securities and Exchange Board of India (Sebi), in 2014, alerting the regulator about suspicious trading activities of these offshore entities. However, in its filings before the Supreme Court of India, Sebi said it initiated a probe against the Adani Group as late as 2020, raising questions over whether the regulator indeed probed the leads shared by DRI and the outcome of the earlier investigation.

“Sebi takes cognizance of every complaint shared with it and follows the rule book to take it to its logical conclusion,” a former Sebi executive said on condition of anonymity. “I cannot share if we did probe (the Adani Group) then because the matter is sub judice, but please remember that in any such investigation, we need cooperation from overseas regulators. Not all overseas regulators have been that helpful,” the person said without sharing any details.

U.K. Sinha was the Sebi chairman in 2014; earlier this year, he became the chairman of New Delhi Television Ltd, the Delhi-based broadcaster acquired by the Adani Group last year.

An email sent to a spokesperson for Sebi remained unanswered.

The Adani Group has called the OCCRP report “recycled allegations” and an attempt to revive the “meritless Hindenburg report”.

“We categorically reject these recycled allegations. These news reports appear to be yet another concerted bid by Soros-funded interests supported by a section of the foreign media to revive the meritless Hindenburg report.”

The group also added that the cases cited in the OCCRP report on DRI were closed more than a decade ago, and even the Supreme Court upheld the clean chit given to the Adani Group in the matter. The case pertained to allegations of over-invoicing, transfer of funds abroad, related-party transactions and investments through foreign portfolio investors. “An independent adjudicating authority and an appellate tribunal had both confirmed that there was no over-valuation and that the transactions were in accordance with applicable law,” the Adani Group added.

The allegations assume significance since Sebi’s minimum public shareholding (MPS) norms prohibit promoters from owning more than 75% of a company. If any fund has common ownership with the promoters, then the shares owned by the fund will be included in the promoter group.

Last week, Sebi submitted a status report on its investigations into the Adani Group. The apex court took cognizance of a writ petition filed in February and set up an expert committee to examine various aspects of the Adani-Hindenburg saga.

In its status report, Sebi said it was probing the violation of MPS norms by the Adani Group between 2016 and 2020. However, the regulator added that the investigation into the MPS norms is not finished since Sebi had to contact several overseas regulators for the information.

Download The Mint News App to get Daily Market Updates & Live Business News.

Updated: 01 Sep 2023, 12:18 AM IST