Along with this, Moody’s has reduced the corporate family rating of Vedanta Resources from CAA1 to CAA2. Additionally, the rating of senior unsecured bonds issued by Vedanta Resources Limited and its wholly owned subsidiary has also been downgraded to CAA3 from CAA2.

After the market closed, news raising concerns about Vedanta has come. Moody’s Investors Service has downgraded the Corporate Family Rating (CFR) of Vedanta Resources Limited, the parent company of India-listed company Vedanta Limited, in view of the increasing risks of debt restructuring in the next few months.

Additionally, the rating of senior unsecured bonds issued by Vedanta Resources Limited and its wholly owned subsidiary has also been downgraded to CAA3 from CAA2. The bonds issued by Vedanta Resources Finance II PLC, a wholly owned subsidiary, are guaranteed by Vedanta Resources Vedanta Limited.

Meaning of CAA3 ratings

Moody’s Investors Service defines the CAA3 rating as highly speculative and near default but with some possibility of recovery of principal and interest. CAA3 comes under betting grade and is considered to be of poor condition. It is subject to very high credit risk.

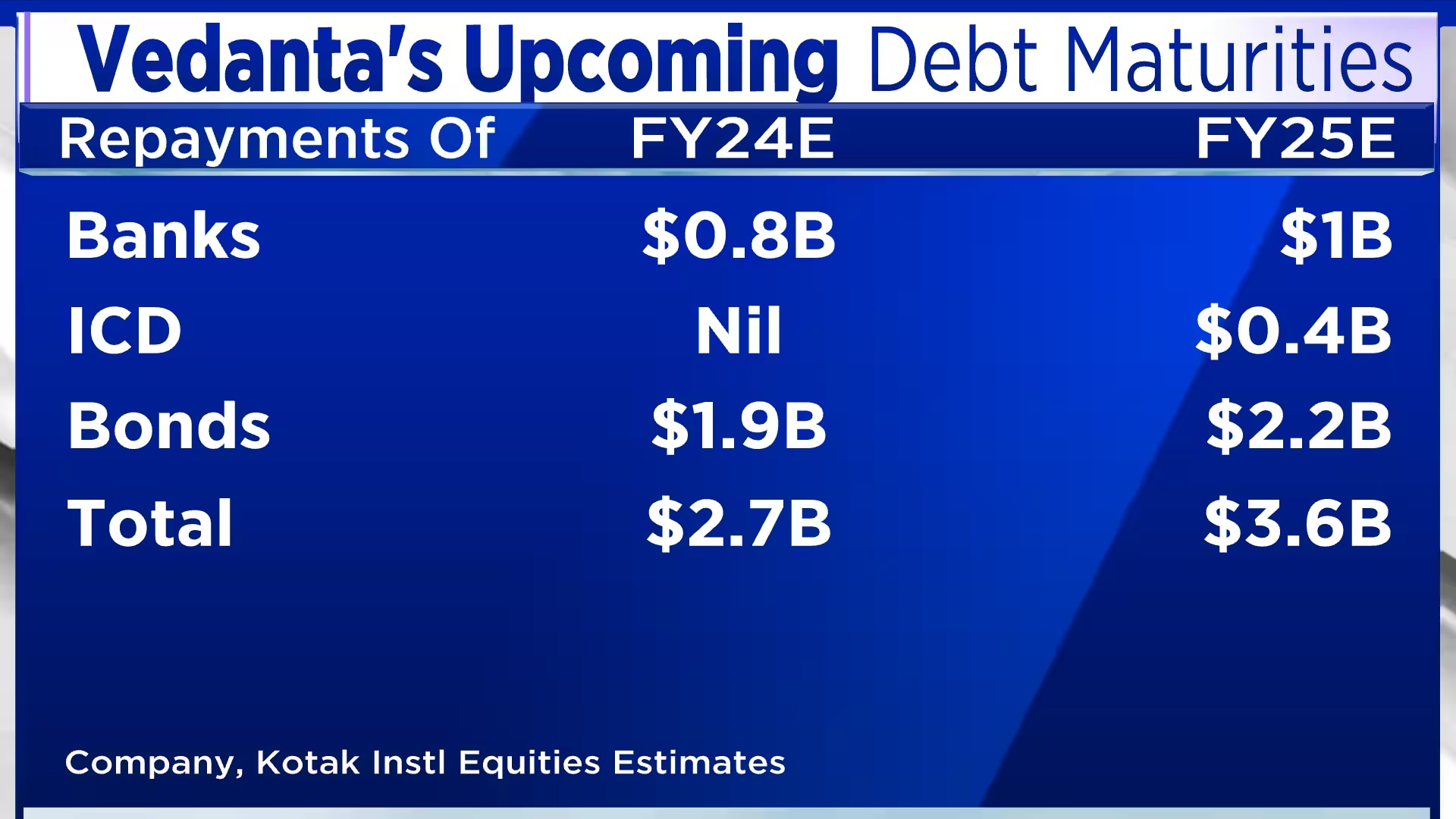

Kaustubh Chaubal, senior vice president at Moody’s and lead analyst at Vedanta Resources Ltd, said, “The downgrade points to increased risk of data restructuring over the next few months, as Vedanta Resources Ltd faces its upcoming debt maturity period, specifically January 2024. And no meaningful progress has been made on the refinancing of $1 billion of bonds maturing in August 2024.”

According to Kotak Institutional Equities, Vedanta’s parent company faces repayment of notes worth about $2 billion in financial year 2025. Including these bonds, the company will have to make debt repayments worth $3.6 billion in the next financial year.

Moody’s Investors Service wrote in its note that “Vedanta Resources is facing weak liquidity, due to which its credit quality has been affected. The reason behind this is the company’s large refinancing needs and strict financing conditions in the global market.