Dealerships have transitioned from lean inventories in 2020-2023 to excessive stock levels in 2024.

Dealerships have transitioned from lean inventories in 2020-2023 to excessive stock levels in 2024. New Delhi: The auto retail sector in India is undergoing a significant transformation. However, for dealers, 2024 has brought a unique set of challenges—ranging from evolving consumer expectations and high inventories to the transition toward electrification.

The post-COVID pent-up demand and growth have stabilised, with double-digit growth seen in 2022 and 2023 tapering to single digits in 2024. The sudden surge in demand after the pandemic had led to an expansion of dealerships and touchpoints for OEMs, but some of these establishments are now struggling to maintain their market share and remain viable.

Evolving consumer trends

One notable trend is the increasing demand for premium variants and luxury vehicles. Rising disposable incomes and the aspirations of the expanding middle class have driven steady growth in high-end car sales, boosting dealers’ top and bottom lines. This has created opportunities for dealerships to cater to a more affluent consumer base by enhancing customer experiences with personalised services, home deliveries, exclusive events, and bespoke vehicle customisations.

While 2023 was financially rewarding for dealerships, 2024 has been a mixed bag. Dealers representing growing OEMs continue to thrive, while others face dwindling sales and rising overheads. Challenges such as high inventory levels, skilled workforce shortages, increasing operational and infrastructure costs, and changing customer expectations have compounded difficulties for the dealer fraternity.

Skill shortages amid technological evolution

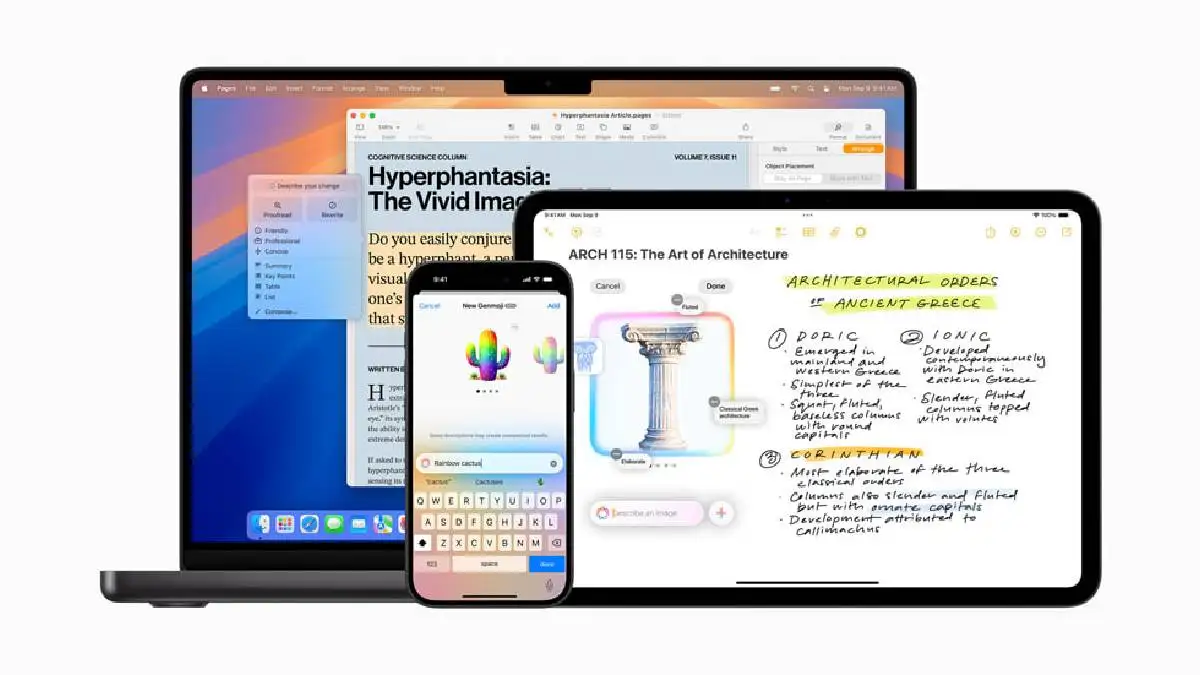

The rapid pace of technological advancements in the automotive industry, particularly the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), has underscored the need for a highly skilled workforce. However, the Indian automotive retail industry is grappling with a shortage of technicians and trained sales staff proficient in handling these new technologies.

Despite commendable efforts by the Automotive Skill Development Council to bridge this gap, the need for specialised training remains significant. Servicing and maintaining EVs require distinct skills compared to internal combustion engine (ICE) vehicles, prompting dealerships to invest in upskilling programs. However, the limited availability of qualified trainers and technical experts poses a challenge.

Rising operational costs

Operational costs for dealerships have surged in 2024. Higher wages for skilled workers, coupled with the expenses of upgrading technology and maintaining inventory for a broader range of vehicles, have strained profitability. Smaller dealerships, in particular, struggle to absorb these costs due to limited financial buffers.

OEMs’ digital-first approach to car buying, intended to improve efficiencies, has paradoxically increased costs for dealerships. Digital integration necessitates additional equipment and expanded tech teams, with little reduction in manpower or significant gains in productivity.

High inventory levels

Dealerships have transitioned from lean inventories in 2020-2023 to excessive stock levels in 2024. Tepid customer demand since May and unregulated production by OEMs have resulted in inventory levels as high as 80–85 days by September, severely impacting profitability. Unsold stock depreciates quickly, especially with new model launches or year-end transitions, forcing dealers to offer heavy discounts to clear ageing inventory.

Optimism amid challenges

Despite the hurdles, the future of auto retail in India remains promising. The electric vehicle push is expected to accelerate in 2025, with over 15 launches planned across various price points. Additionally, the expanding middle class will drive demand for both affordable and premium vehicles.

Dealerships must embrace digital transformation, invest in employee training, and adapt to regulatory changes to thrive in this evolving landscape. Those who navigate these challenges successfully and innovate to meet consumer demands will be well-positioned to capture growth in India’s dynamic automotive market.

.jpg&c=0&w=700)