New Delhi: As everyone’s eyes on the upcoming budget to be presented by finance Minister Nirmala Sitharaman on February 1, hopes from all sections of society run high on government’s allocation for the next fiscal and projection of economic survey a day before the budget as well. Keeping the continuity of past reforms unchanged, the government, however, is expected to balance the budget with prudent fiscal management for the Indian economy by offering some reliefs to the middleclass (especially on their personal tax), youth, farmers, elderly and small businesses in the country.

Apart from creating more jobs for youth and containing high inflation, the government is also learnt to have announced some new measures in the areas like the most talked-about artificial intelligence or AI for driving the economic growth in the country. Among all the slew of relief, the issue of taxation is the main focus of the government in the budget. In order to boost consumption demand, more money in the hands of the salaried and middleclass are likely as the government may tweak the personal income tax slabs in the new tax regime and a hike in various exemptions as well.

“As the move of the government aims to boost the consumption demand to drive the growth and keep the momentum for the same, there are expectations of changes in income tax slabs in the new tax regime and a hike in various exemptions. Introduction of the voluntary NPS contribution deduction in the new regime; hiking deductions available for health and life insurance premiums paid are also on the wishlist for budget changes for the new tax regime,” a top source privy to the development said on Wednesday.

GDP Growth On Track

With the falling GDP in the second quarter of 2024–2025 to 5.4 percent, a seven-quarter low and a decline from the 8.1 percent growth in the same quarter of 2023–2024, the government may project a higher growth rate in its economic review to maintain its largest growing economy of the world. It hopes normalisation of nominal GDP, higher revenue growth following revival in consumption, and rationalisation of subsidies will give the government much needed fiscal room to lower deficit levels. Key areas expected from the government include tax reforms, MSME support, artificial intelligence, and increased subsidy allocation. Economists suggest measures to spur demand and private investment while maintaining fiscal discipline.

Capital Expenditure

The government is expected to allocate more on its capital expenditure, mostly in the infra sector, railways, defence and social sector. The total expenditure for the 2024-2025 Budget was estimated at Rs 48.2 lakh crore, an increase of 8.5 per cent from the actual expenditure in 2023-2024, where the infrastructure sector got Rs 11.11 lakh crore, 3.4 percent of GDP. But this time, the government may increase its allocation to boost economic growth and create more jobs.

Exemption of Tax

As the industry giants gave a clarion call to bring some relief for middleclass and salaried people, the speculation is rife that some tax reforms, including change in tax slabs, may take place. For instance, the old tax regime may get phased out and introduction of zero income tax for those earning less than Rs 10 lakh per annum. There may be an increase in exemption and deduction limits in both the new and old income tax regime, like interest paid on home loans, health and life insurance premiums paid, voluntary NPS contributions by the employee, and more. This is largely needed to boost the slowing urban consumption and increase the in-hand income of Indians.

Curbing Inflation

As India’s rising inflation has been a key concern for policymakers, the government may take some measures despite asking the Reserve Bank of India to keep the inflation levels within its tolerance band of 2-6 per cent. The recent inflation print for the month of November stood at 5.48 per cent on an annual basis, while in October, the rate hit a 14-month high of 6.21 per cent, surpassing the upper end of the central bank’s target. Also, food prices, which make up about half of the consumer price basket, climbed 10.87 per cent from a year earlier.

Fiscal Prudence

As India is facing a bumpy road in 2025 due to a slew of economic risks, including weakening rupee, declining FDI, volatile inflation, changes in fiscal and monetary policy is likely in the budget. The government is expecting to boost domestic demand, particularly in the investment front while aiming for a fiscal deficit of less than 4.5 per cent of GDP for the next fiscal. In 2023-24, the fiscal deficit was 5.6 per cent of GDP, which is estimated to come down to 4.9 per cent in the current fiscal.

Export & Import

The trade policy of the government is set to be the main focus in this budget for exports and imports. However, industry leaders hope that the Budget 2025 may give a boost to manufacturing and reduce import dependence from other countries. The government is likely to bring some changes in customs duty of some goods and take steps to revive export-boosting schemes, such as the interest equalisation scheme, offer financial support to exporters, and enable flexibility for certain service sector units in special economic zones.

Strengthening Defence Sector

As heightened military presence continues at the broader LAC with China, allocation in the defence budget will be in focus with expected increase in capital expenditure. Also, there may be a special focus on procuring indigenous weapons as part of the government’s Atma Nirbhar endeavour. The defence budget was Rs 6.2 lakh crore, the largest among all ministries. It was 5 per cent higher than the previous year’s allocation of Rs 5.94 lakh crore. The government is expected to increase the allocation in the upcoming budget.

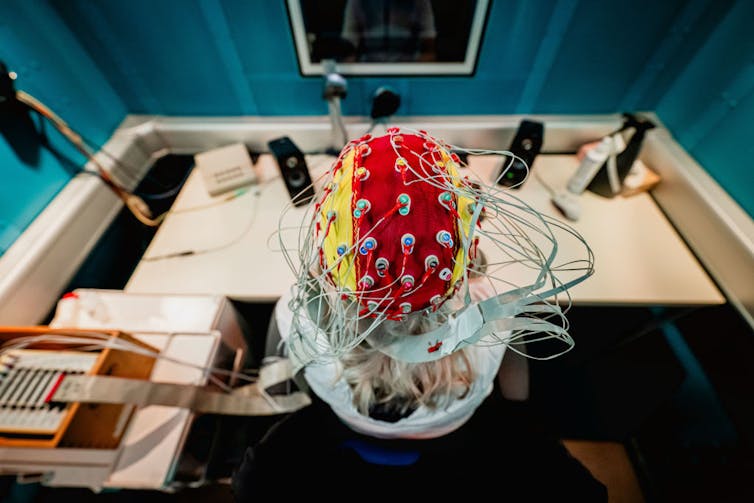

Bridging Digital Divide With AI

The government is focussing some measures in a new concept, artificial intelligence (AI) to bridge the gap between digital and AI ventures. It will help all sections of society to fasten their productivity, including farmers and boost the sectors like agriculture, manufacturing etal. Besides, tax benefits may adopt emerging technologies like AI, announcement to set up dedicated manufacturing zones, and expanding credit guarantee schemes in the Budget will help boost the growth of SMEs. Experts say that AI-based credit assessments and risk profiling can streamline loan approvals and widen credit access for SMEs.