All of the Tokyo Stock Exchange’s 33 industry sub-indexes fell, with automaker shedding 5.25% to become the worst performer.

All of the Tokyo Stock Exchange’s 33 industry sub-indexes fell, with automaker shedding 5.25% to become the worst performer.Japanese shares fell more than 2% on Monday, with automakers leading the decline, as concerns over the global economy mounted following U.S. President Donald Trump’s tariffs on Canada, Mexico, and China.

The Nikkei was down 2.42% at 38,612.96 at the midday break, while the broader Topix dropped 2.25% to 2,725.91.

The White House said the United States would impose 25% tariffs on Canada and Mexico, and China with a 10% levy. Canada and Mexico immediately vowed retaliatory measures, and China said it would challenge Trump’s levies at the World Trade Organization.

“Japanese stocks fell amid uncertainties about the global economic outlookwhich includes worries that Japanese exports may be a target of Trump’s tariff policy in the future,” said Kentaro Hayashi, senior strategist at Daiwa Securities.

“Also, if prices rise in the U.S. and the dollar strengthens, yields will rise. That may affect Japan’s monetary policy.”

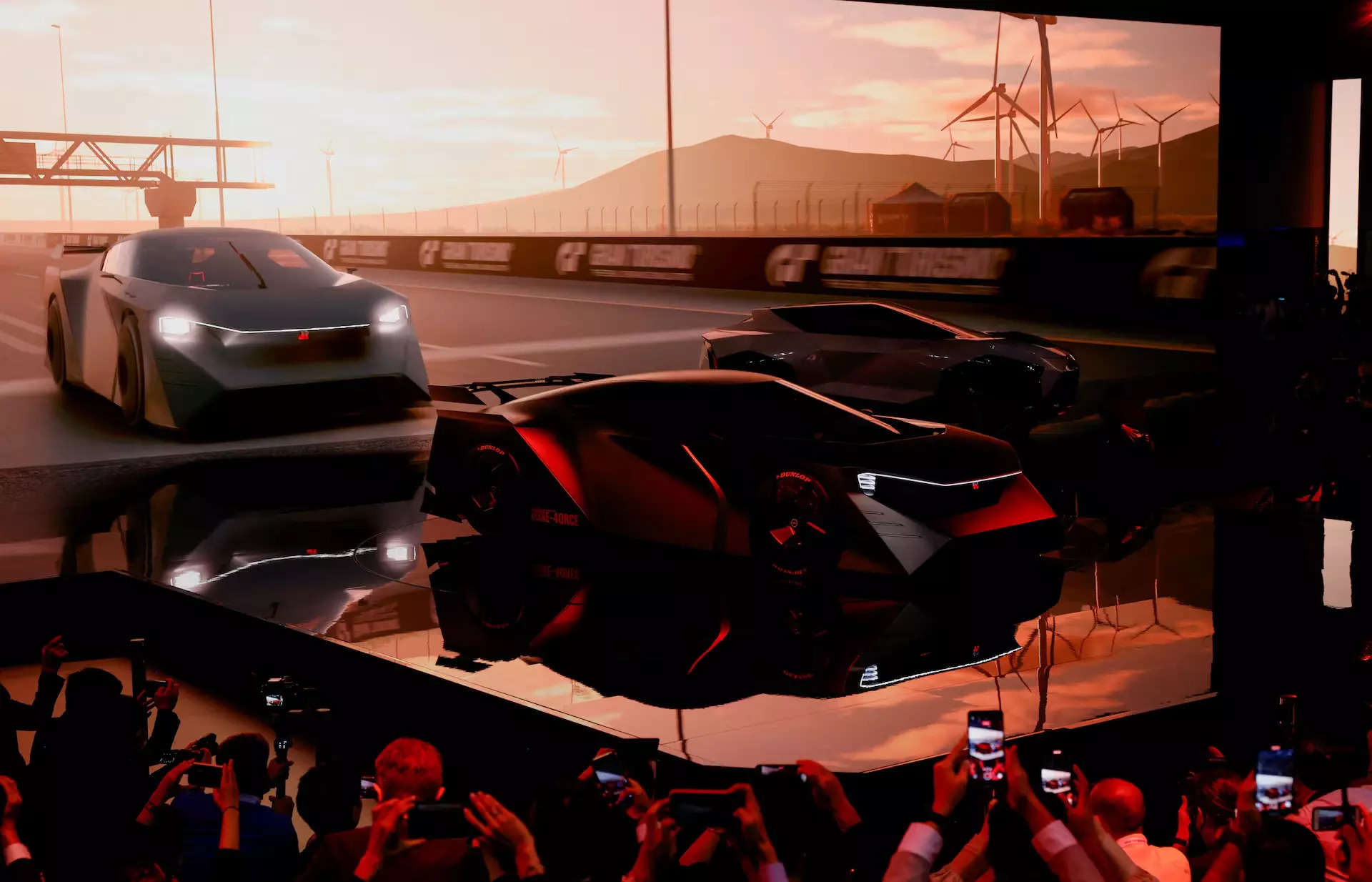

Automakers slumped, with Toyota Motor losing 5.53% to drag the Topix the most. Honda Motor fell 7.1% and Nissan engine lost 5.28%, with strategists saying their auto production in Mexico is bigger than their Japanese peers.

In contrast, Suzuki Motor, which pulled out of the United States, posted only a marginal loss of 0.27%.

“If automakers face higher tariffs, they would have to raise prices and their competitiveness might be hurt,” said Fumio Matsumoto, chief strategist at Okasan Securities.

All of the Tokyo Stock Exchange‘s 33 industry sub-indexes fell, with automaker shedding 5.25% to become the worst performer.

The Nikkei volatility index rose to its highest level since mid-December at 25.33 and was last at 24.78. Shares of video game developer Konami Group jumped 13.62%. Scandal-hit Fuji Media Holdings surged 11.48%. Of the more than 1,600 stocks trading on TSE’s prime market, 87% fell and 11% rose, with 1% trading flat.

.jpg&c=0&w=700)