The state presently has over 17 lakh CNG/LPG vehicles, with many of them in dual variants of petrol and CNG.

The state presently has over 17 lakh CNG/LPG vehicles, with many of them in dual variants of petrol and CNG.Buying a private CNG or LPG vehicle in Maharashtra is set to become more expensive from April 1 as the govt proposed an increase of 1% tax on such vehicles across all categories. Electric vehicles will also be taxed for the expensive variants—those costing over Rs 30 lakh—with a one-time flat tax rate of 6%.

The govt proposed the tax hike for private CNG/ LPG vehicles only and not for commercial vehicles used as public transport such as autos, taxis and buses.

After making the announcements in the budget, deputy CM Ajit Pawar informed the media that there was still zero tax on all e-vehicles costing less than Rs 30 lakh, which was an incentive for citizens to purchase environmentally-friendly cars or bikes.

Pawar said, “Motor vehicle tax is currently levied at the rate of 7% to 9% on individual-owned and non-transport four-wheeler CNG and LPG vehicles, depending on the vehicle type and price. It is proposed to increase this tax rate by 1%.”

For example, a CNG vehicle that costs up to Rs 10 lakh presently attracts a tax slab of 7%. So if one buys a CNG car for Rs 10 lakh, the tax payable is Rs 70,000; with the budget proposal, this could increase to Rs 80,000. Similarly, if the CNG vehicle cost is Rs 20 lakh, the present-day tax is Rs 1.4 lakh, which could go up to Rs 1.6 lakh. The state presently has over 17 lakh CNG/LPG vehicles, with many of them in dual variants of petrol and CNG.

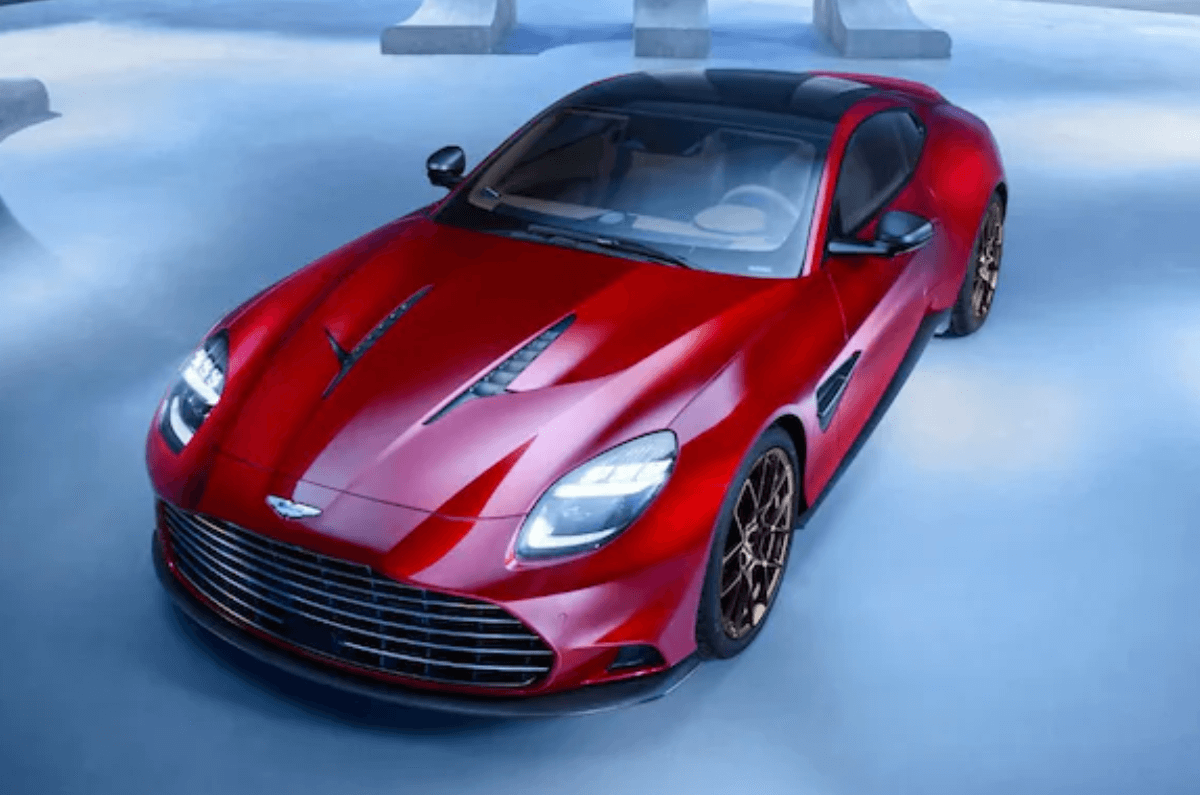

Pawar said in his speech, “The proposed increase in motor vehicle tax rate is expected to generate additional revenue of around Rs 150 crore.” He further said the state proposed to levy a 6% one-time tax on electric vehicles priced above Rs 30 lakh. In such a scenario, if the e-vehicle costs around Rs 40 lakh, the owner will have to pay the state Rs 2.4 lakh.

“Also, the maximum limit for MV tax so far was Rs 20 lakh (which was the ceiling), and this has now been proposed to be increased to Rs 30 lakh,” the budget stated, adding that this will generate additional revenue of around Rs 170 crore for the state in 2025-26.

A transport official said that for high-end foreign-made cars (petrol or diesel), when the tax was computed, it would come to Rs 30 lakh or above in a few cases, but the vehicle owner had to pay a maximum Rs 20 lakh tax as per rules. “The state can now earn more by levying a maximum of Rs 30 lakh as tax,” he added.

Some other proposals included levying motor vehicle tax, compulsorily on a lump sum basis, at the rate of 7% on prices of vehicles used for construction such as cranes, compressors, projectors, and excavators — which will generate an additional Rs 180 crore.