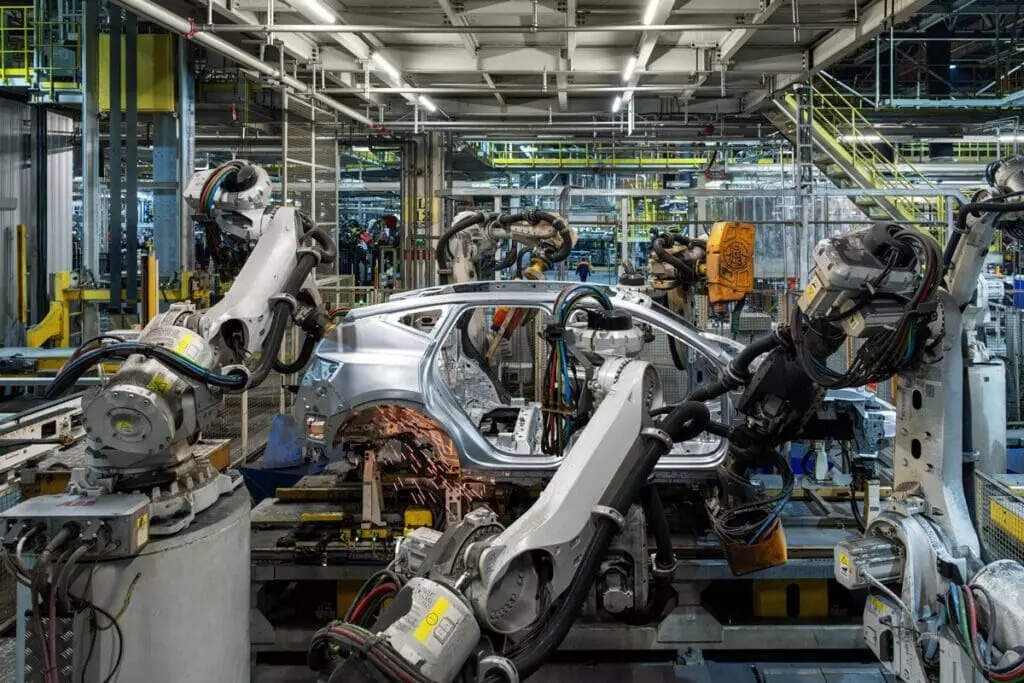

Polestar said on Monday it had secured a $200 million equity investment from major shareholder PSD Investment, a company controlled by Geely Holding founder Li Shufu.

The Swedish electric vehicle maker will sell more than 190 million Class A American depositary shares (ADS) to PSD Investment, which will now hold 44 per cent of Polestar.

After the transaction, Li Shufu will hold a total of 66 per cent in Polestar through PSD Investment and the Swedish subsidiary of Geely.

The Swedish automaker has faced challenges in boosting demand for its vehicles amid a softer market and intense competition, and like many other EV makers, had a need for further funding.

While the automaker has received loans from various banks in the past year, further financial support from Geely and Li Shufu, also known as Eric Lihave until now not materialized.

The transaction will also reduce Volvo Cars’ stake in Polestar to 16 per cent from 18 per cent, after the Swedish automaker cut its holding and halted financial support last year amid analyst criticism over the burden Polestar placed on its resources.

Polestar said the private investment in public equity (PIPE) transaction is intended to provide working capital and fund general corporate purposes.

The company said that prior to the closing of the transaction PSD Investment plans to convert 20 million of its Class B ADS shares into Class A ADS shares, in a bid to keep its total voting power in Polestar below 50 per cent.