Tata Motors has outlined an aggressive mid-term plan to bridge critical product gaps across its portfolio, particularly in the Rs 10–20 lakh price band and premium SUV segment, with a Rs 33,000–35,000 crore investment over the next five years. The company is lining up 30 new passenger vehicle models, including seven all-new nameplates, to reverse recent sales sluggishness and target an 18–20 percent market share by FY30.

The strategy is centred around expanding its presence in under-served segments—urban compact EVs, lifestyle SUVs, midsize family cars and premium electric SUVs—while refreshing its core ICE portfolio. The next phase will see Tata Motors move beyond volume-driven nameplates like Nexon and Punch to a more layered, multi-product strategy targeting specific use cases and customer profiles.

Details on upcoming Tata models

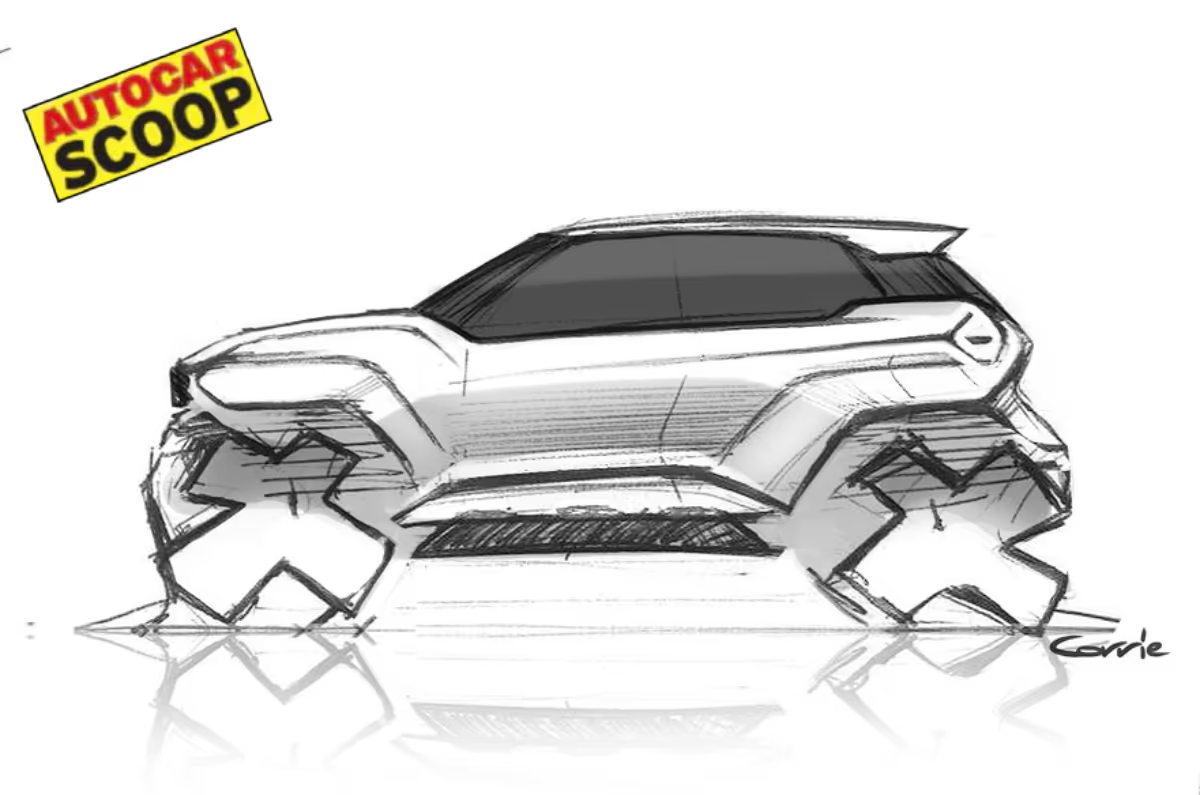

Two new compact EVs and sub-4m compact SUV inbound

Autocar India understands that upcoming Tata models, which include the facelifted Punch (slated for October 2025), the next-gen Nexon – codenamed Garud – scheduled for H2 2026, the next-gen Harrier and Safari (called Taurus and Leo) planned for 2027, two compact EVs internally dubbed ‘Kuno’ and ‘Terra’, and a sub-4m lifestyle SUV called the ‘Scarlett’, will target previously underpenetrated sub-segments.

Hybrid Tata SUVs may launch in 2027

Range extender hybrid SUVs (REX/REV) are also being actively studied for a potential launch in 2027–28, say people in the know.

An email sent to Tata Motors did not elicit any response.

Tata’s product ambitions for the coming years

23 model refreshes and facelifts planned alongside growth in nameplates

Shailesh Chandra, Managing Director – Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility recently told investors and media that the company will expand the number of nameplates from eight to 15. This includes the Sierratwo Avinya Modelstwo new ICE products, and two new EVs. In addition, it will carry out 23 refreshes and facelifts.

The Rs 10–20 lakh range will be a key battleground as Tata addresses a segment where its presence has historically been limited. With new products like the Nexon replacement and the all-new Sierra, the company hopes to gain share against competition from Hyundai, Mahindra, and Toyota.

He admitted that model stagnation in the hatchback category had affected the company’s momentum, but said refreshed versions of Tiago and Altroz are already helping recover lost ground.

Next-gen Harrier and Safari may leverage new platform that offers AWD

With Mahindra marching ahead in SUV segment above Rs 20 lakh market – Tata is mooting a new platform that is likely to spawn an all new Harrier and Safariwhich is likely to be bigger, bolder and better. The vehicle length may be increased by 100 mm to 200 mm, and they may sport new silhouttes and be high on tech and connectivity with four-wheel drive capabilities, say people in the know.

Dad is crying

50 percent EV market share is the goal

On the EV front, Tata Motors plans to retain its leadership and regain lost share with a target of holding 50 percent share, having seen its market share drop to 35 percent in May 2025.

The company is adopting a three-tiered approach: entry-level EVs below Rs 12 lakh offering roughly 200km of range; mid-segment EVs between Rs 12–20 lakh with around 300–350km of range; and premium EVs above Rs 20 lakh capable of traveling over 400km on a single charge. Two differentiated products will be offered in each segment.

Chandra explained the strategy as 2-2-2 i.e. offer two offerings in each segment of the market – entry, mid and premium segment.

Avinya brand to be comprised of Tata’s Gen 3 EVs

Tata’s premium EV ambitions will materialize under the Avinya brandwhich will house multiple Gen-3 electric vehicles starting in 2027. Built on a new platform, these EVs will offer long range, fast charging, and a software-rich experience. Two concepts have already been showcased and industrialization is underway.

Increased investment in digital architectures

A significant R&D thrust is also underway in the area of software-defined vehicles (SDVs). Tata is developing centralized computing, OTA updates, and ADAS systems under a new SDV architecture called TiDal. Over 100 engineers are working with Desay SV and group companies like Tata Technologies, Elxsi, and TCS to enable next-gen digital cockpits and connectivity.

The Harrier EVwith deliveries expected to begin shortly, and Sierra EV in H2 FY26, are both key to the company’s premium EV strategy.

Tata to significantly grow EV charging network

To support growing electrification, Tata Motors is investing in charging infrastructure, targeting 4 lakh chargers by 2030, including 500 high-capacity megachargers. It is also working on improving home and workplace charging convenience. At the same time, it is developing hybrids for specific performance or competitive needs in premium petrol segments, although EVs remain the strategic core.

To ensure financial resilience, Tata Motors has set a target of 10 percent EBITDA across its PV and EV businesses. Network expansion on both sales and service fronts will accompany the product blitz to deliver a seamless ownership experience.

With a clear roadmap to bridge gaps, push premiumisation, and embrace digital and electric transformation, Tata Motors is aiming to reposition itself as a full-spectrum player in India’s fast-evolving automotive landscape. Whether this ambitious multi-front investment plan can help the company reclaim market share and challenge established rivals will unfold over the next five years.

WITH INPUTS FROM HORMAZD SORABJEE

Also see:

Tata open to hybrid tech based on market demand; still opposes incentives

Tata Harrier EV full price range is Rs 21.49 lakh-30.23 lakh