GST on small cars could be reduced from 28 percent to 18 percent; cess is also expected to be removed.

On Independence Day last month, Prime Minister Narendra Modi announced a major GST reform aimed at simplifying the existing four-slab GST structure to a simpler two-slab system. As per Reuters, nearly 175 products, including automobiles, will be affected by this tax overhaul. The finance minister Nirmala Sitharaman-led GST Council, which has representatives from the country’s states, is set to meet on September 3-4 to finalise the details of the new GST structure, the items that will be affected and by exactly how much.

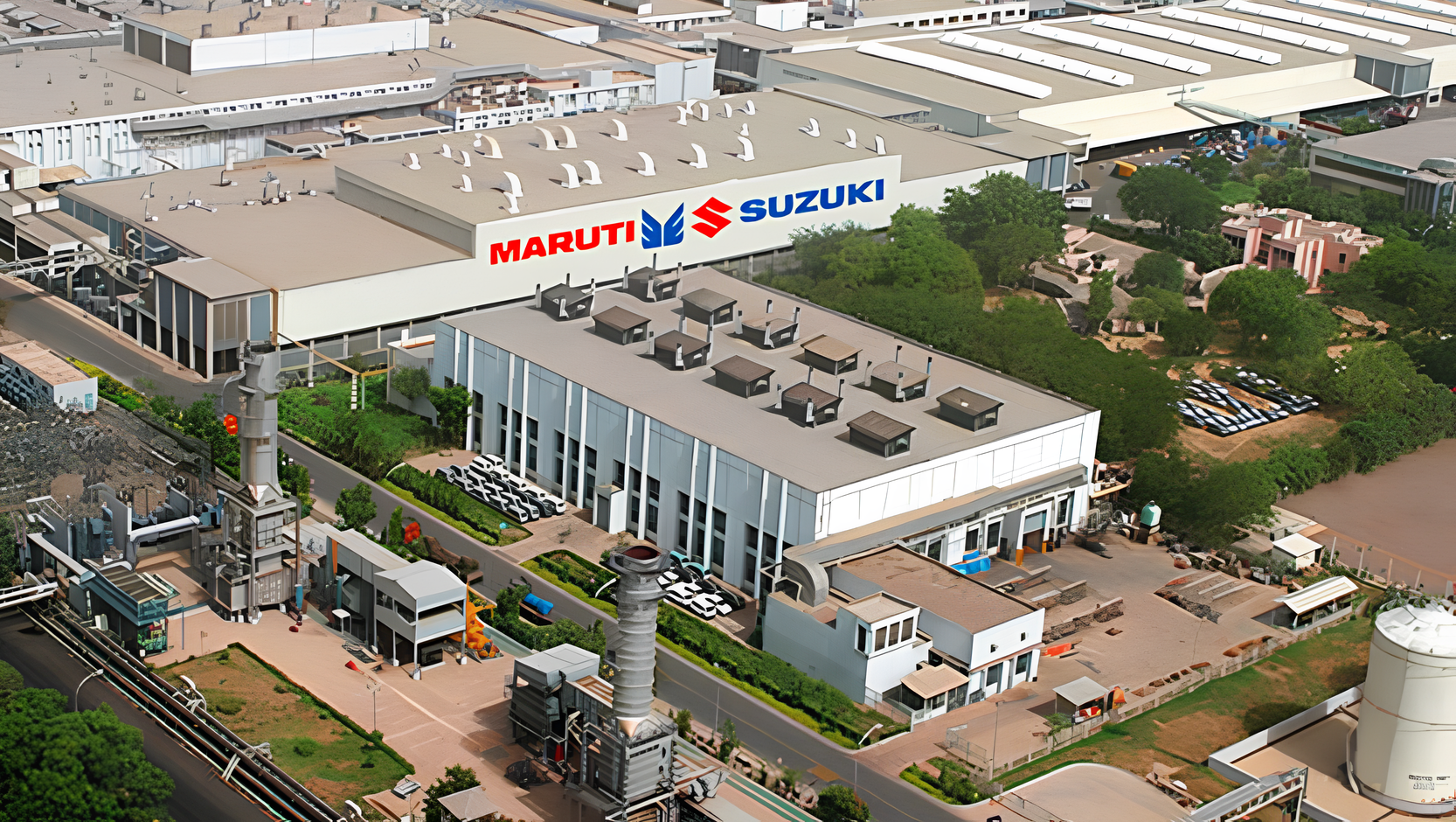

The automotive sector, particularly the small car segment, is expected to see a 10-percentage-point reduction in GST. It could provide a huge impetus to small car sales in India, but in the short term and just ahead of the festive season, several carmakers have reported a decline in volumes as customers are holding off purchases in anticipation of reduced prices.

Existing GST on cars explained

Before we delve into how the new GST structure could potentially affect car prices, let’s take a look at the existing tax slabs.

| GST slabs on cars explained | ||||

|---|---|---|---|---|

| Vehicle category | GST | Cess | Total tax payable | |

| Sub-4m vehicles with up to 1200cc petrol engine | 28% | 1% | 29% | |

| Sub-4m vehicles with up to 1500cc diesel engine | 28% | 3% | 31% | |

| All cars with up to 1500cc engine | 28% | 17% | 45% | |

| All cars with above 1500cc engine | 28% | 20% | 48% | |

| SUVs (above 4m, above 1500cc engine, more than 170mm GC) | 28% | 22% | 50% | |

| Sub-4m hybrids with up to 1200cc petrol or 1500cc diesel engine | 28% | Nil | 28% | |

| Hybrids with above 1200cc petrol or 1500cc diesel engine | 28% | 15% | 43% | |

| Electric vehicles | 5 percent | Nil | 5% | |

As you can see in the table above, apart from EVs, all passenger vehicles across segments have a uniform 28 percent GST. Additionally, there’s a cess of 1 percent to 22 percent levied, depending on the vehicle size, fuel option and engine capacity.

How will small car prices be affected?

Small cars expected to see the largest drop in taxation

The government has proposed reducing the GST on sub-4m vehicles with petrol engines up to 1,200cc and diesel engines up to 1,500cc from 28 percent to 18 percent. Additionally, the cess levied on sub-4m vehicles (ranging from 1 percent to 3 percent) could be eliminated altogether. That could effectively bring down taxes on sub-4m petrol and diesel vehicles by 11-13 percentage points. However, hybrid sub-4m vehicles could see a 10-percentage-point reduction in tax because there’s no cess in the first place.

How will large car prices be affected?

GST on 4-metre-plus cars is expected to increase, but cess will reduce

.jpg?w=700&c=0)

All vehicles longer than 4 metres and with petrol engines larger than 1,200cc or diesel engines larger than 1,500cc are now expected to attract a higher 40 percent GST, as the government sees them as ‘sin or luxury goods’. However, as per Reuters, the cess for this category (currently in the 15-22 percent range) will be lowered to keep the overall rate at around 50 percent. Depending on the body type, fuel and engine capacity, this segment will see a lesser revision in taxes than the sub-4m category.

How will EV prices be affected?

Premium and luxury EVs could become more expensive

Lastly, and rather surprisingly, the GST on EVs is expected to go up. According to the Reuters report, EVs priced between Rs 20 lakh and Rs 40 lakh will see GST rise from 5 percent to 18 percent. It could, therefore, impact our homegrown EVs like the Tata Harrier EV and Mahindra Xev 9E. Meanwhile, electric cars priced over Rs 40 lakh could fall under an even higher GST slab, meaning that the Mercedes, BMW and Tesla EVs will also become more expensive. The tax panel has reportedly cited that such vehicles cater to the society’s “upper segment” and are largely imported rather than manufactured domestically. However, there is no clarity on the GST on entry-level EVs.

Conclusion

The vehicles likely to benefit the most from the GST reform are those in the sub-4m vehicle category, with small petrol and diesel engines. This could be a huge boost to small and entry-level car sales, which have been on a steady decline due to increasing prices and the growing popularity of used cars. Meanwhile, premium and luxury EVs could become more expensive, and this could slightly deter the growth rate of EVs in India. Lastly, midsize and large vehicles, including luxury cars, are likely to be the least affected by the change in taxation.

Also See:

Supreme Court dismisses PIL against E20 petrol rollout

Warranties valid even on E20 fuel, say Govt and industry panel