This festive season, car prices have never been this attractive. Tap to see how GST 2.0 cuts and seasonal discounts are making everything from hatchbacks to premium SUVs a steal.

For months, Indian car buyers have been in wait-and-watch mode. But 2025 has brought a decisive turning point. The sweeping GST 2.0 reformcombined with the natural spike of festive-season demand, has created a buyer’s market not seen in years. For once, affordability, availability, and sentiment are all aligned, which is what we explore to see why this is the best time to buy a new car.

GST 2.0 sparks permanent price cuts

Mass market models like the Sonet, Venue and Thar are up to Rs 1.86 lakh cheaper

The new GST structure is more than a technical adjustment, it’s a structural reset of car prices. Compact cars and sub-4-metre SUVsonce taxed at nearly 31%, now fall under a flat 18% GST slab. Larger SUVs and sedans have been simplified into a 40% rate, replacing the old multi-layered cess system.

The result is stark: permanent, double-digit price corrections. The Hyundai Venue is cheaper by Rs 1.33 lakh, the Let Sonet be by Rs 1.86 lakh, and the Mahindra Thar by Rs 1.35 lakh.

The Tata Nexon has seen a significant price correction. Its price has been reduced by Rs 1.55 lakh, plus an additional Rs 45,000 in offers, making the car nearly Rs 2 lakh cheaper for buyers. For instance, the top model that cost Rs 15.8 lakh last Diwali is now priced at Rs 14 lakh (excluding current festive deals).

Entry hatchbacks like the High k10 now start below Rs 4 lakh on-road in some cities, attracting a larger pool of first-time buyers. The S-PassIndia’s cheapest car, is now even cheaper than its 2019 launch price.

Diesel makes a comeback

GST 2.0 has narrowed the petrol-diesel price gap

This tax reset has created another compelling trend. Just a few years ago, diesel engines looked like they were on borrowed time. Stricter emission norms and higher taxes had pushed many automakers to scale back. But GST 2.0 has narrowed the petrol-diesel price gap so significantly that diesel variants are staging a comeback.

Diesel fuel also has no ethanol blendingso buyers don’t need to worry about the government’s E20 or E27 rollout plans that may impact petrol cars in the coming years.

Diesel remains best suited for high-mileage use and frequent highway driving. For those driving primarily in the city or covering limited distances, diesel models may still be prone to Diesel Particulate Filter (DPF) issues.

For high-mileage users, especially in Tier-2 and Tier-3 cities, diesel cars like the 3xo, Syrosand Bolero are suddenly compelling again, with reductions as high as Rs 1.86 lakh.

Their higher torque and range now come without the heavy upfront premium, a trend that could extend diesel’s life cycle in India, even as EVs gradually scale.

Festive discounts stack the deck

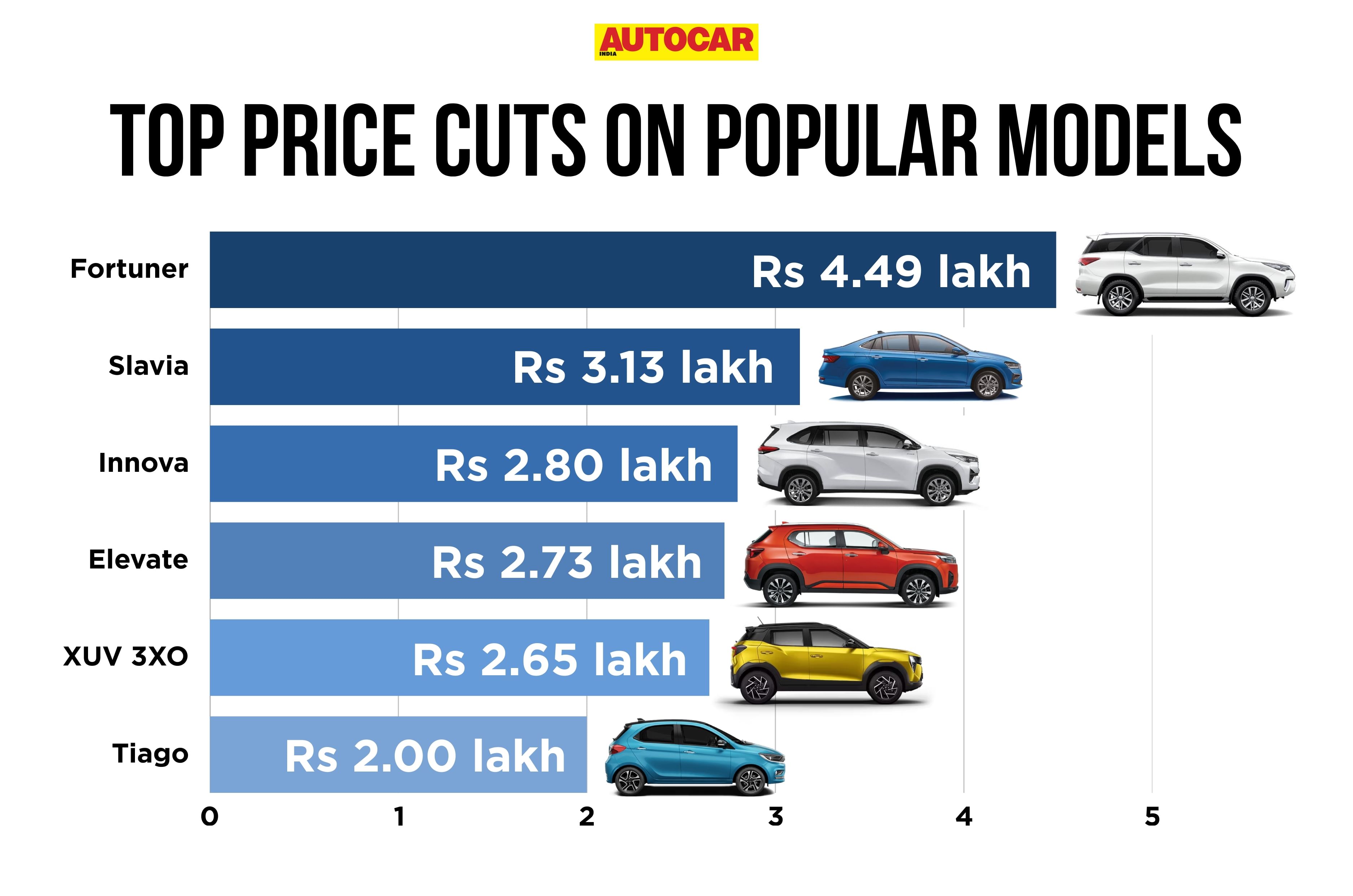

Mass market and premium models get significant discounts and benefits

This structural price reset could not have come at a better time. On top of permanent GST-driven cuts, this festive season brings one of the richest rounds of offers in recent years. Mass-market models like the Kia seltos and MG Hector see benefits of Rs 2 to 3 lakh, while premium EVs such as the Hyundai Ioniq 5 enjoy limited-time discounts exceeding Rs 5 lakh.

The double layer, permanent tax reductions plus seasonal sweeteners, creates a rare convergence of value.

| Price reduction from last year | |

|---|---|

| Model | Difference from 2024 Diwali |

| Honda City | Up to Rs 2.05 lakh |

| Tata Nexon | Up to Rs 2.2 lakh |

| Volkswagen Virtus | Up to Rs 2.57 lakh |

| Kia seltos | Up to Rs 2.78 lakh |

Cars that felt “just out of reach” last Diwali are now firmly attainable. Even premium models see meaningful cuts: the Skoda kodiaq enjoys a combined GST and festive reduction of Rs 5.8 lakh, while the Toyota Fortuner is cheaper by Rs 4.5 lakh.

The used car ripple effect

The affordability extends beyond showrooms. The used-car market is also under pressure, as pre-owned prices adjust downward to stay competitive against cheaper new models.

For instance, Spinny has announced discounts of up to Rs 2 lakh across its stock of pre-owned cars.

For buyers, this creates two parallel opportunities: negotiate a better deal on a used car, or upgrade to a new one with the confidence that the upfront savings soften any depreciation.

Sentiment and Sales Revival

The early signs are striking. Automakers reported record footfalls and enquiries on the very first day of GST 2.0’s rollout. This is more than a short-term spike; it signals renewed confidence across the broader economy. Car sales drive multiplier effects across auto components, logistics, finance, and insurance, and a buoyant market often sparks wider consumption cycles.

Maruti Suzuki’s Partho Banerjee, Senior Executive Officer, Marketing & Sales, said:

“The customer response has been nothing short of phenomenal, something we haven’t seen in 35 years. We recorded 80,000 enquiries on day one, delivered over 25,000 cars, and bookings are soaring nearly 50% higher than usual. Demand for small cars is especially strong, and some variants may even run out, with dealers working late into the night to keep up with the momentum.”

Hyundai Motor India’s Tarun Garg, Whole-Time Director & COO, added:

“The auspicious start of Navratri, boosted by GST 2.0 reforms, has brought strong positivity to the market. With 11,000 dealer billings, this is our best single-day performance in five years. This reflects robust festive sentiment and customer confidence.”

The Bottom Line

This festive season is more than a shopping window, it’s a historic price correction layered with short-term sweeteners. The opportunity extends across new and used cars, petrol and diesel, urban and rural markets.

With permanent GST cuts and festive deals converging, this could be the most buyer-friendly Diwali in years.

For buyers, the question has indeed shifted. It’s no longer “should I buy a car this year?” The real question is: why would you wait any longer?

Also see:

Biggest discounts and benefits on cars this festive season

Compact cars with the biggest price cuts after new GST 2.0 rates

![[Hindi] BMSD 2025 | Quarter Finals | Day 1 [Hindi] BMSD 2025 | Quarter Finals | Day 1](https://i.ytimg.com/vi/WBqEvuQdO84/maxresdefault.jpg)